Financial institutions are operating in an environment increasingly characterized by risks that are more complex and dynamic than ever in a world of rapid technological change. Risk is born in market volatility, regulatory compliance challenges, cybersecurity threats and economic disruptions. Yet here, technological advances, particularly Artificial Intelligence (AI), fundamentally change how financial institutions think about risk management.

The integration of AI into risk management strategies is no longer simply an option. Still, it is necessary to provide organizations with insights into what might happen in the future while maintaining the efficiency of operations and capacity to respond to what they don’t know anymore.

This blog explores how effectively AI could redefine the world of financial institutions’ risk management, the various facets of applications driving this transformation, the pros, and how financial institutions stand a chance to make the most of AI to mitigate risk, optimize operations, and survive in an unpredictable financial landscape.

The AI Revolution: A New Era in Risk Management

Artificial Intelligence isn’t only about improving processes; it’s about fundamentally rethinking how risk is perceived, understood and managed. Traditionally, risk management has been a reactive discipline, constantly reacting to discoveries of threats, often through manual processes, intuition and historical trends, without adequate effort spent predicting threats before they occur. However, this conventional approach is disrupted by AI; AI stands out in terms of its predictive capabilities, real-time monitoring and automation.

Financial institutions can use AI-driven risk models that offer a transition from reactive to proactive, predictive intelligence—catching risks earlier than they grow. This shift is critical amid market volatility, new financial instruments, and the ongoing challenge of new technology (cybersecurity breaches and changes in consumer behaviour, among other things).

It allows the future of financial services to be powered by AI, which can take those huge data sets and detect patterns that had been too complex or made too complex but were not visible. Thus, the future is almost exclusively in the hands of AI. Financial institutions use AI to make decisions with tools that enhance decision-making by using historical data to anticipate patterns, find anomalies, and optimize risk strategy.

Key Applications of AI in Financial Risk Management

Risk management is a field of application of multifaceted AI technology. On multiple fronts, its capability to process data fast, spot trends, and make predictions in real time is making its mark across multiple aspects of financial operations. Below are several areas where AI has already begun making a difference:

-

Data Analytics & Predictive Modeling

At the foundation of AI’s application in financial risk management is its ability to analyze data at an unprecedented scale. Financial institutions deal with vast amounts of data from market trends, historical financial information, transaction logs, credit histories, and real-time economic signals. AI processes these diverse data streams through advanced algorithms to identify patterns and predict outcomes.

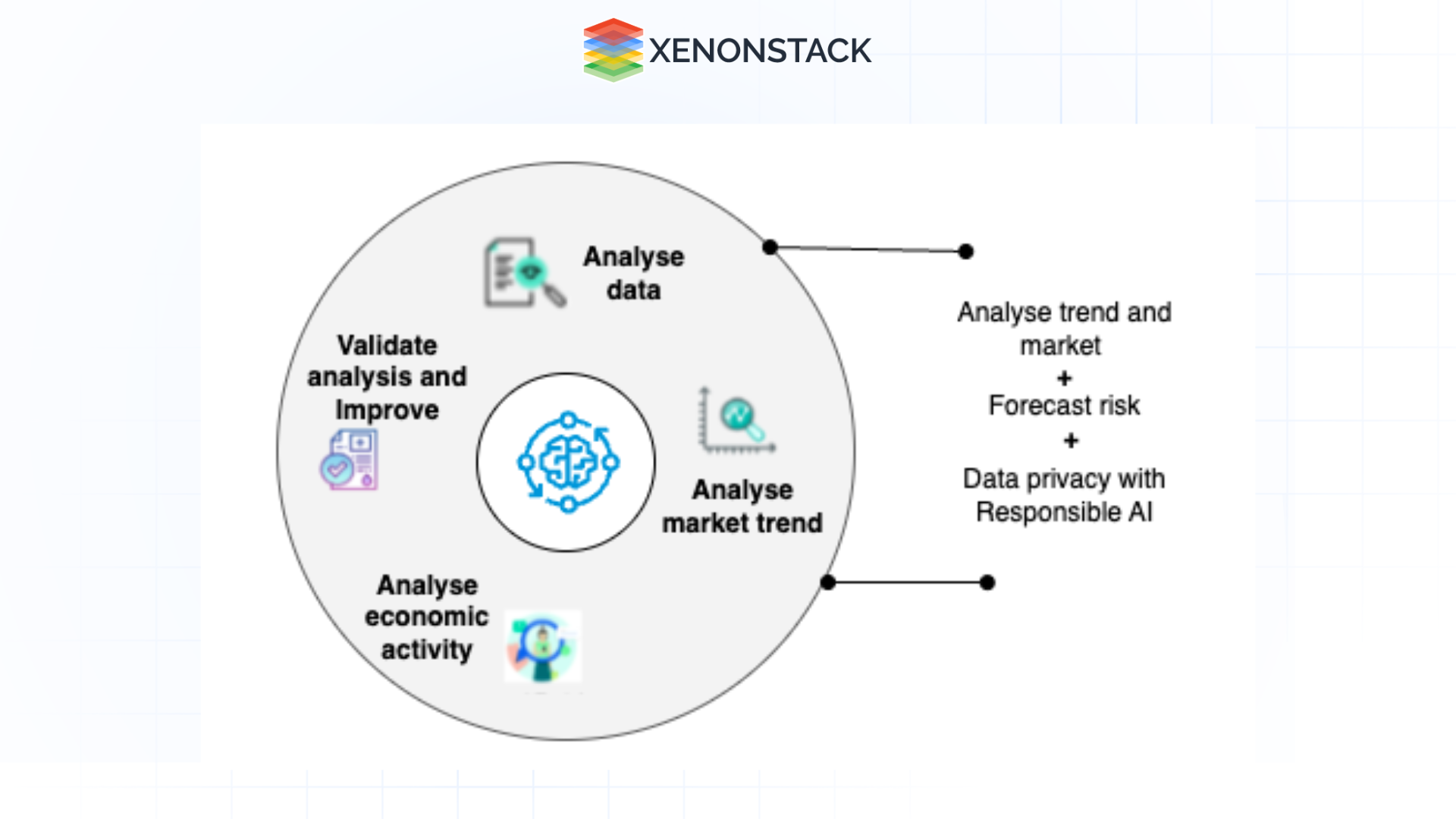

Fig1.1 Data Analytics with AI

Fig1.1 Data Analytics with AI AI-driven data analytics can forecast credit defaults, market trends, and liquidity risks by recognizing subtle patterns in historical data—something traditional risk models cannot always uncover.

For instance:

-

Predictive algorithms can assess a company’s financial health by analyzing its payment history, market trends, and economic activity.

-

AI can identify market shifts by evaluating macroeconomic indicators and asset movement patterns.

-

Fraud detection through pattern recognition ensures financial institutions can quickly monitor transaction anomalies to flag suspicious activities.

By implementing predictive AI tools, financial institutions can make more informed, forward-looking decisions that help them navigate risks before they escalate.

-

AI-Powered Cybersecurity Defense

Financial institutions remain prime targets for cyberattacks, from ransomware threats to data breaches. These costly threats can destabilize financial institutions and entire economies if not mitigated effectively. AI offers financial services the ability to enhance their cybersecurity defences by monitoring digital networks in real-time.

AI-powered cybersecurity solutions use machine learning and pattern recognition to detect anomalies or irregular patterns in network traffic—signals that may indicate unauthorized activity. Some of these applications include:

-

Anomaly Detection: AI algorithms scan for deviations in data flows, identifying hacking attempts, data exfiltration, or fraudulent login attempts.

-

Real-Time Threat Detection: AI continuously monitors system behaviour, flagging cyber threats as they emerge and responding faster than traditional cybersecurity defences.

-

Behavioral Analytics: AI identifies typical user behaviour and flags any activity deviating from these norms as a potential threat.

AI’s agility enables financial institutions to stay ahead of cybercriminals, creating robust defence mechanisms that evolve in response to new threats in Real-Time Intelligence.

-

Generative AI: Simulating Risk Scenarios and Financial Modeling

The frontier of generative AI is introducing predictive modelling by generating likely financial scenarios. The AI generates synthetic data based on real-world financial conditions to help financial institutions conduct stress testing and scenario planning with conditions ranging from the obvious to the nightmarish.

For instance:

-

Financial institutions can simulate extreme market events such as economic slumps, geopolitical uncertainty, and supply chain disruptions, in which case they would observe how their strategies hold up under these pressures.

-

Firms can use these simulated models to perform advanced risk stress tests and identify vulnerabilities across portfolios and investment strategies.

By incorporating generative AI into risk management, financial institutions can prepare for "worst-case" scenarios that might never occur but can help strengthen their response strategies when unexpected market disruptions arise.

-

AI and Credit Risk Scoring

Credit risk has always been a cornerstone of financial risk management. AI transforms this space by replacing traditional scoring models with dynamic, real-time credit evaluation tools. AI algorithms can assess hundreds of data points to evaluate creditworthiness more accurately and quickly than traditional models.

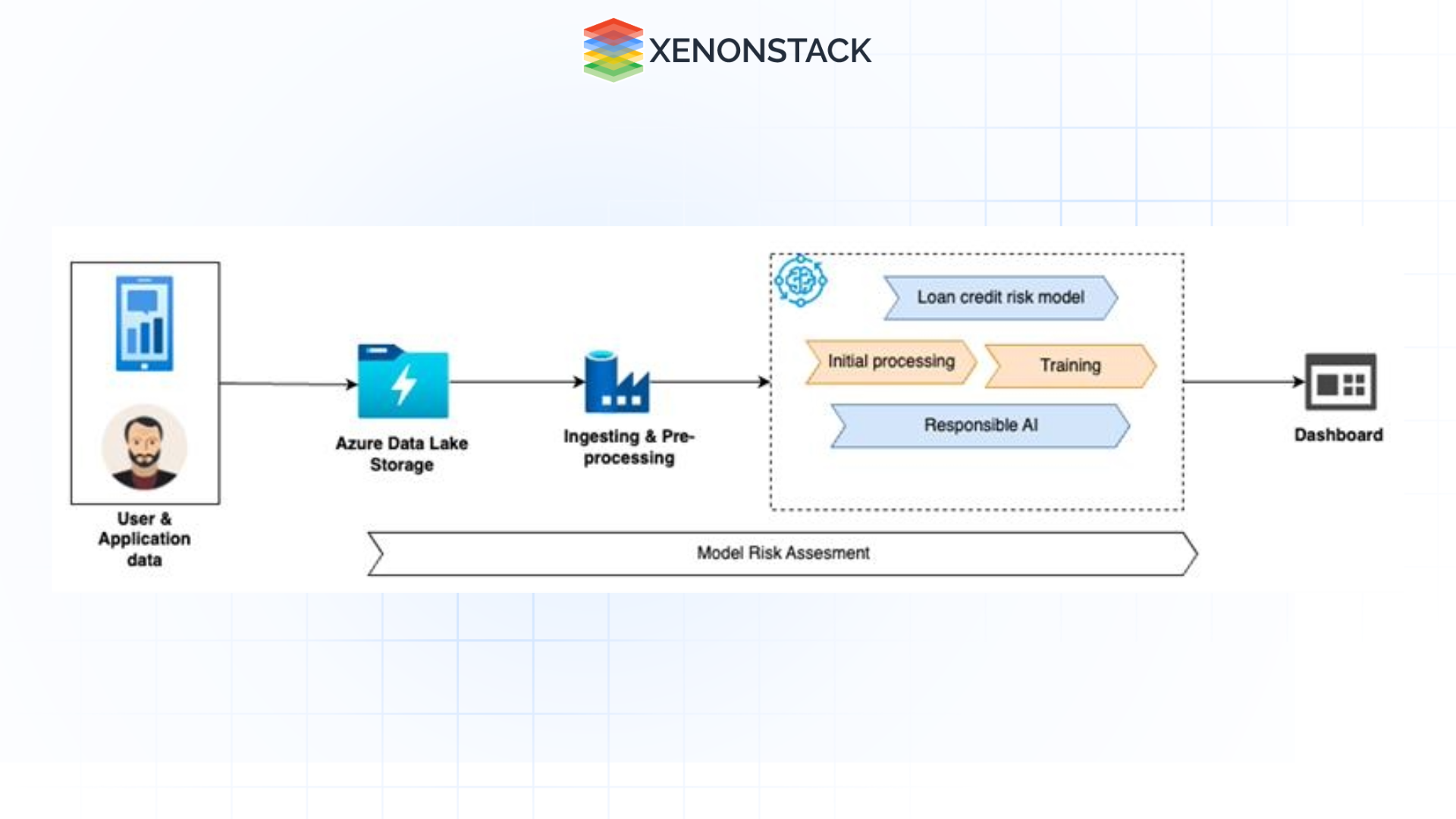

Fig1.2. Loan credit risk analysis using AI

Fig1.2. Loan credit risk analysis using AIAI-powered credit risk models take into account:

-

Traditional credit data (payment histories, debt-to-income ratios, loan defaults)

-

Alternative signals (behavioural data, market conditions, social media insights)

-

Real-time financial patterns

This allows financial institutions to quickly identify high-risk clients or borrowers while improving accuracy and reducing bias that might affect manual or traditional credit risk analysis.

-

Fraud Detection with AI’s Pattern Recognition

Fraudulent activity is a persistent risk that has grown more complex with the rise of digital banking and online transactions. AI's ability to analyze behaviour patterns and detect anomalies makes it an invaluable asset in fraud detection.

AI algorithms establish benchmarks for “normal” transaction behaviour and identify transactions that deviate from these patterns. This helps financial institutions flag potentially fraudulent transactions faster and with fewer false positives, saving resources and protecting customers.

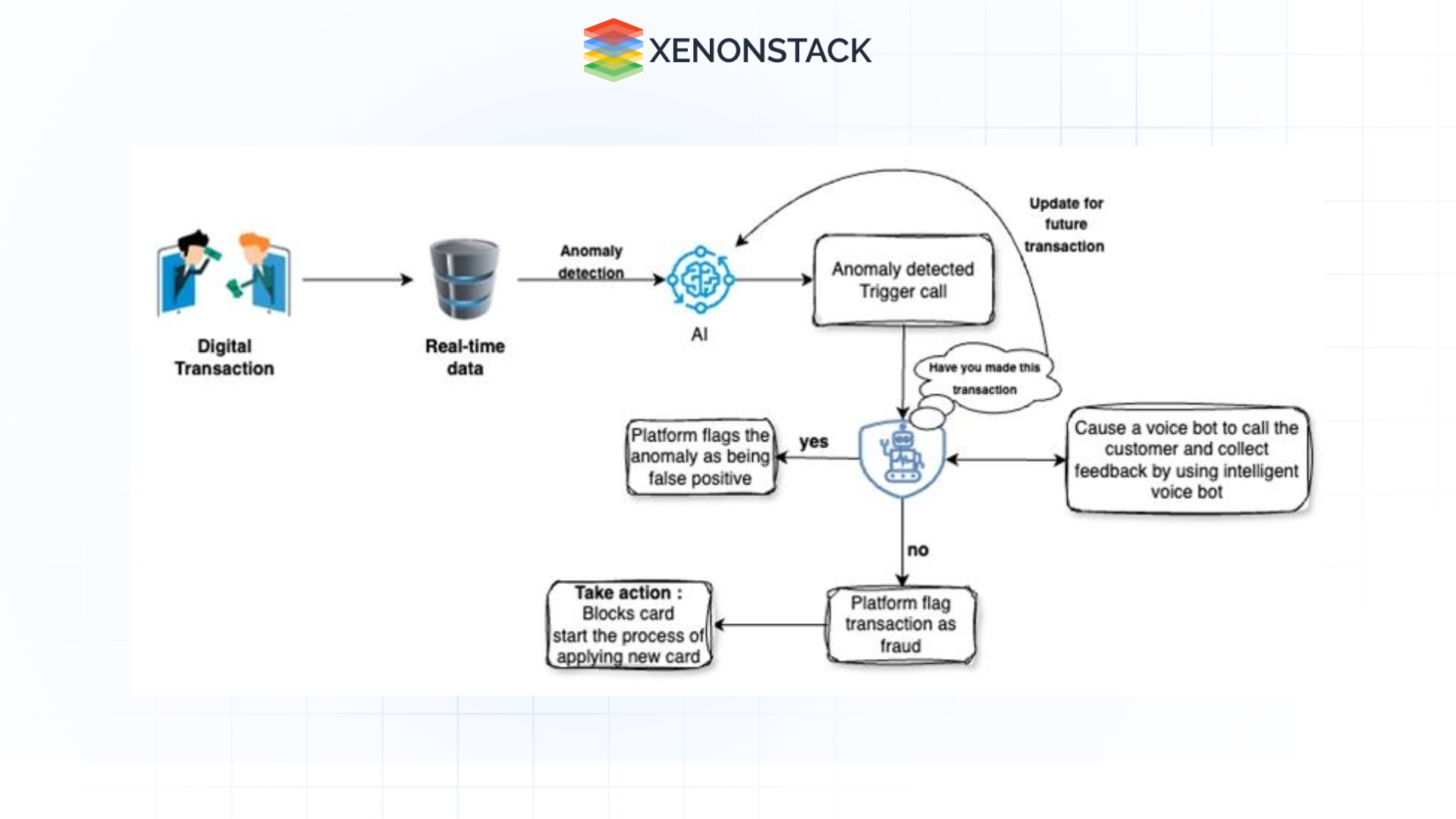

Fig1.3. Fraud detection with AI

Fig1.3. Fraud detection with AIExamples of AI-driven fraud detection include:

-

Monitoring sudden, large transactions from a previously low-activity account.

-

Identifying patterns associated with account takeovers or stolen credit card usage.

-

Cross-referencing behavioural anomalies with historical financial activity.

Advantages of AI in Financial Risk Management

-

Automation of Routine Processes

AI automates repetitive and time-consuming tasks, reducing operational bottlenecks and human error. Automation allows financial managers to focus on strategic planning rather than mundane administrative work. AI-powered systems can monitor transactions, credit data, and portfolio risk assessments, identifying anomalies and potential risks faster than humans.

-

Real-Time Monitoring and Decision-Making

The ability to make timely decisions is critical in financial markets. AI enables institutions to monitor data streams in real time, assess risks as they arise, and adjust strategies quickly. This level of speed and precision would be unattainable through traditional human-led analysis alone.

-

Higher Accuracy in Predictions

AI models follow objective data-based processes, significantly reducing the likelihood of human biases or oversight. This leads to more accurate market predictions, improved fraud detection, and effective risk assessment strategies.

-

Enhanced Customer Experience

AI’s ability to personalize financial strategies and risk profiles based on customer behaviour allows financial institutions to meet clients' needs better while mitigating risks associated with lending and other financial transactions.

- Innovation in Product Development & Strategies

AI empowers financial institutions to innovate, leveraging predictive insights to identify new opportunities and market trends. From new lending models to optimized insurance strategies, AI's predictive capabilities drive innovation.

The Future of AI in Risk Management

The role of AI technology in financial risk management will get bigger. Many financial institutions’ challenges today, such as data silos, market disruptions, and regulatory complexities, can be solved by AI.

Financial institutions can expect the following:

-

AI systems can intelligently integrate vast, disparate data sources to create a cohesive risk management strategy.

-

The AI offers more personalized financial solutions derived from the individual’s behaviour and market trends.

-

The dependence on AI-generated insights to solve resource allocation and competitive positioning problems.

Integrating AI and financial risk management systems demonstrates a shift towards using advanced risk strategies, including predictive models and full data analysis using AI.

Conclusion: A Financial Future Powered by AI

The transition from AI adoption to financial risk management is a strategic change in how financial risk is focused, monitored, and mitigated rather than merely a technological change. Even as AI reshapes every aspect of market prediction, fraud detection, and cybersecurity, its integration into financial risk management strategies provides a once-in-a-lifetime opportunity to improve decision-making, operational efficiency, and customer trust dramatically. It’s not about replacing human judgment; it’s about augmenting it and giving financial institutions a pathway to more agility, accuracy, and vision through the adoption of AI.

By utilizing AI as a starting point for risk intelligence, financial institutions can effectively form risk insights on uncertainty, seize every opportunity, and secure the economy's financial stability amid a rapidly changing economic ecology. AI powers the future of financial services: smart, predictive, and transformative.

Next Steps with Financial Institutions

Consult our experts about implementing advanced AI systems and how financial institutions can leverage Decision Intelligence to enhance risk management strategies. Utilize AI to automate and optimize risk assessment and mitigation processes, improving efficiency, accuracy, and responsiveness.