Today’s financial institutions deal with a lot of paperwork daily, be it invoices, applications for loans, bank and other statements, tax returns, etc. Previously, processing such documents was manual, time-consuming, error-prone, and inefficient. Computer vision is an innovative technology in AI that is revolutionizing how financial documents are processed. It replaces humans, minimizes cost, and increases efficiency. This blog explores how computer vision has been applied to financial document processing, the technologies supporting it, the present uses, benefits, drawbacks, and emerging possibilities.

What Is Computer Vision?

Computer vision is a division of AI that allows computers to perceive, recognize and understand digital images or videos. Like human vision systems, computer vision systems capture, analyze, synthesize and interpret visual signals to gain knowledge, make decisions and recognize events and objects. In financial document processing, computer vision technologies make machines process financial documents and facilitate the common activities entailing reading the documents to carry out tasks such as data extraction, classification and validation.

Key Technologies Driving Computer Vision in Financial Automation

Several technological advancements underpin the use of computer vision in financial document processing:

Optical Character Recognition (OCR)

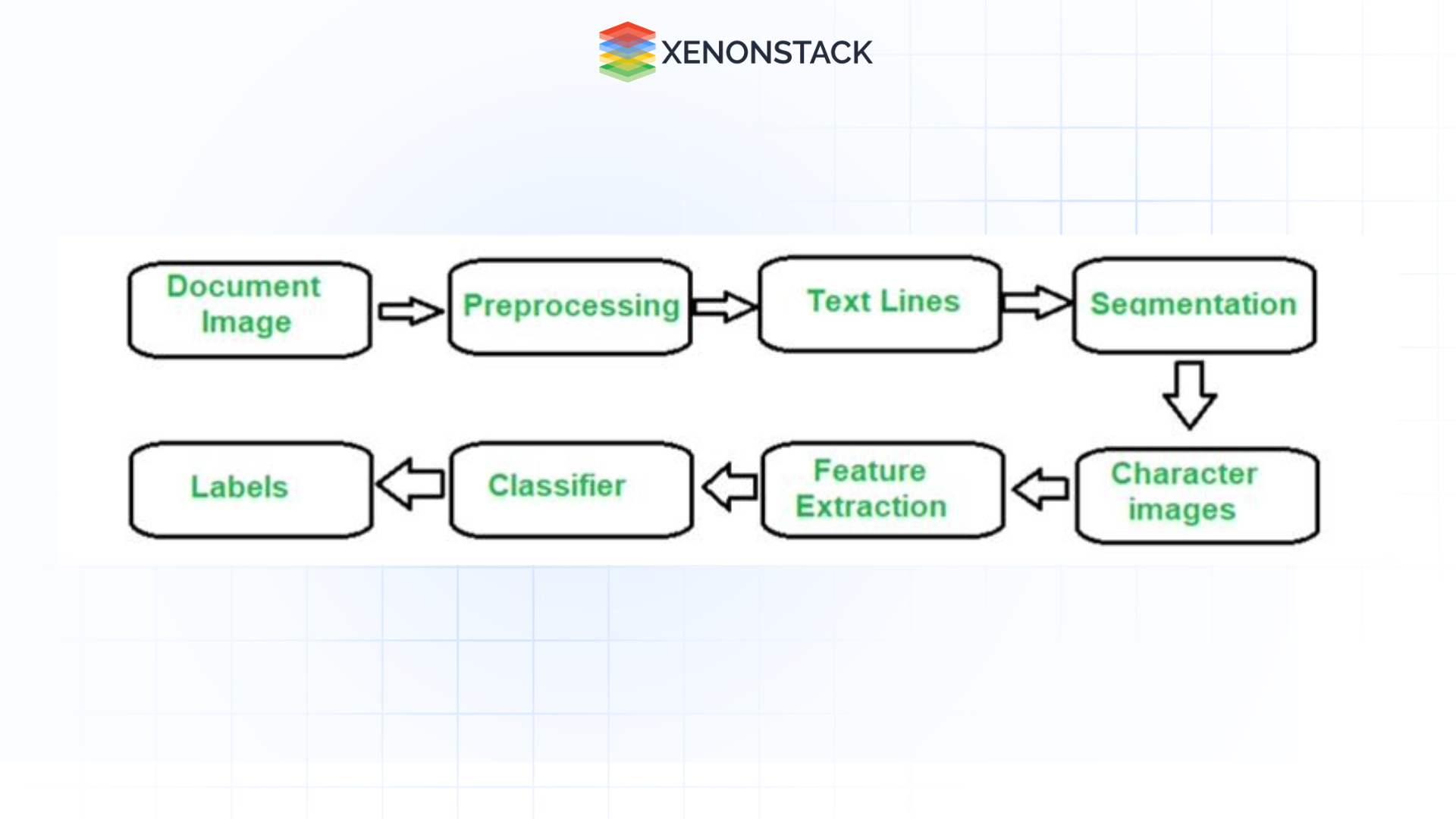

Figure 2: Flow diagram of OCR

Figure 2: Flow diagram of OCR-

Definition: OCR is used to extract text from scanned images and documents.

-

Advancements: Current OCR solutions based on deep learning algorithms allow us to handle various document layouts, handwriting, and languages.

-

Tools: Some popular OCRs used in industries include Google Vision AI, ABBYY FineReader, and Textract OCR.

Natural Language Processing (NLP)

-

Definition: NLP helps interpret the extracted text and understand its context.

-

Use Case: Separating text data from invoices and converting the data into more easily analyzable structures.

Convolutional Neural Networks (CNNs)

-

Definition: CNNs are deep learning models designed to process visual data.

-

Use Case: Identifying tables, headers, signatures, and logos in documents.

Document Layout Analysis

-

Definition: AI models that recognize document structures, including headers, footers, sections, and tables.

-

Example: Detecting itemized sections in an invoice or categorizing pages in a financial report.

Generative AI for Missing Data

-

Definition: AI models generate or predict missing values in incomplete documents.

-

Example: Predicting missing account details in partially scanned records.

Applications of Computer Vision in Financial Document Processing

Invoice Processing

-

Challenges: Managing multiple invoices generated from different vendors results in dealing with many forms of invoices. Format variations, such as layout font and language differences, make processing and analyzing the data time-consuming and tiresome.

-

Solution: OCR and document layout analysis provide machine-processed invoice numbers, dates of invoices, total amounts, tax breakdowns, and payment terms.

-

Impact: Automation eliminates the keying in of records, fast processing, and fewer errors, which means faster payments and a stronger relationship with the vendors.

Loan Document Validation

-

Challenges: When reviewing loan applications, several papers, including paychecks, credit reports, and bank statements, must be examined; these tasks can be time-consuming and exhausting, as they can be confusing and, hence, always involve many errors.

-

Solution: Income data, credit scores, and identity confirmation are extracted from such documents through a process performed by computer vision systems and compared to verify their accuracy.

-

Impact: Customers are happy because they do not have to wait long to be approved for loans, and selling these loans is easier.

Bank Statement Analysis

-

Use Case: Financial institutions often use bank statements to evaluate a customer's creditworthiness.

-

Example: Automated processes within artificial intelligence classify transactions as incomes, expenses, and savings, analyze them, and alert them of suspicions such as withdrawals or deposits.

-

Impact: Automating this process improves decision-making efficiency, reduces the chances of making wrong decisions, and is effective in Fraud detection.

Tax Document Automation

-

Challenges: Executive summaries include W-2s, 1099s, corporate tax returns and statements, and other related tax documents, which are usually complex or differ in format, leading to time-consuming and error-prone manual processing.

-

Solution: Organizational software automatically identifies field contents that meet the tax law requirements, applies data validity tests, and arranges the information.

-

Impact: Automation lowers processing time, accuracy and suitability for fueling timely and accurate tax submissions.

Insurance Claims Processing

-

Use Case: Insurance departments manage several documents associated with claims, such as forms, reports, and medical bills, among others, and this information needs to be validated.

-

Solution: Automated information systems help scan such papers, analyze the required points in their letters, notice the differences, and decide which claims are more urgent.

-

Benefit: Claims processed efficiently will automatically result in faster approvals, minimal complaints, reportable incidents, and customer satisfaction.

These applications show how computer vision can revolutionize various financial processes and improve the efficiency and security of business systems, enabling faster services to customers.

Advantages of Using Computer Vision in Financial Document Processing

Improved Efficiency

-

One of the proposed method's most important advantages is that it eliminates the need for extensive calculations and shortens their time by orders of magnitude.

-

Financial institutions can deal with more documents without being a denominator of human capital.

Cost Reduction

-

The expansion of mechanization lessens the dependence on people, which decreases expenditure.

-

Automation makes mistakes more expensive, and the work is more likely to require repetition.

Enhanced Accuracy

-

The accuracy of data extraction and analysis by computer vision systems is much higher than that of human beings.

-

Sophisticated AI algorithms learn with training, and they become better with time.

Scalability

-

Mature occurrence systems can scan thousands of documents daily, and handling a higher volume of work is no problem.

Better Compliance

-

Certain things must be checked and validated to ensure compliance, most of which can be done automatically.

-

Computer vision systems can highlight issues and prevent errors from reaching an audit or fines level.

Challenges in Adopting Computer Vision

Discreteness in Document Formats

-

Several diversified layouts, languages, and formats of financial documents cannot be standardized.

-

Solution: Analyzing large training corpora of documents of different kinds or cross-document types.

Quality of Input Data

-

Medical experts probe to say, and it is true, that the lack of quality scans and images compromises the effectiveness of artificial intelligence.

-

Solution: They feature extraction, enhancement of images, removal of noise, etc.

Data Security Concerns

-

Financial data must BE safeguarded and, therefore, protected to the maximum.

-

Solution: It recommends encrypting operations, using safe AI platforms, and considering rules such as GDPR.

Initial Costs

-

To build and implement AI solutions, one must invest a lot of money initially.

-

Solution: AWS Textract and Azure Form Recognizer identified and minimized initial capital costs associated with implementing AI services.

Emerging Trends and Innovations

-

AI-Powered Self-Learning Systems: AI models that learn from user corrections continuously improve without retraining.

-

Multi-Modal AI: Combining computer vision with NLP to analyze visual and textual data for deeper insights.

-

Federated Learning: Training AI models on decentralized data sources to enhance privacy while maintaining accuracy.

-

Cloud-Native Solutions: Cloud-based computer vision services provide scalability and accessibility for financial institution's

Real-World Use Cases

Steps to Implement Computer Vision in Financial Workflows

-

Define Objectives: Specify general procedures to be implemented for automation, like invoice submissions and loan checks.

-

Select Technology: Select appropriate tools and applications, such as Google Vision AI, ABBYY, Amazon Textract, etc.

-

Train Models: Another type involves using a variety of datasets containing information derived from financial documents to increase the accuracy of the sample models.

-

Integrate Systems: Integration with other established integrated financial software such as ERP or CRM must also be smooth.

-

Test and Iterate: From this, it is essential to test systems on new data to identify more gaps and improve models routinely.

-

Monitor and Secure: Implement robust monitoring and encryption protocols to safeguard sensitive data.

The Future of Computer Vision in Finance

Since the usage of computer vision is in its early stages in financial institutions, there is only a trend for its incorporation to increase in the future with the increased adoption of digitization. Quantum computing, edge AI and blockchain are other new-age technologies that, when incorporated into financial processes, will likely improve computer vision even more.

-

Personalization: Using customer documents to deliver financial services that meet their needs in real life.

-

Edge AI: Uses on-device computation for better performance and the protection of user data.

-

Interoperability: Predictable APIs for cross-platform interoperability and cohesiveness.

Computer vision is also being used to automate the processing of financial documents. It restricts repetitive work and is less error-prone. Due to the availability and developments in AI technologies such as OCR, NLP, and deep learning, financial institutions can transmit large volumes of data inexpensively and effortlessly. Thus, while some issues, such as data security and format variability, continue to present formidable obstacles to the universal adoption of federated learning, strong pre-processing techniques are now in place to span many of these divides. With the help of computer vision, financial organizations improve their work performance indicators and provide customers with faster, more accurate, and more reliable services. The financial industry is at the precipice in a new age of competition where computer vision and AI are critical innovating factors that can keep organizations proactive in the constantly shifting environment.

- Biomedical Image Analysis and Diagnostics

- Essential Insights into Self-Supervised Learning for Computer Vision

- Automating Financial Document Processing with Computer Vision

Next Steps with Automating Financial Document

Talk to our experts about implementing compound AI systems and how industries and departments leverage Decision Intelligence and Automating Financial Documents to become decision-centric. Discover how AI automates and optimizes IT support and operations, enhancing efficiency and responsiveness.

.webp?width=1921&height=622&name=usecase-banner%20(1).webp)