What and Why FinDevOps?

DevOps' Defenders tout key procedures like constant improvement and consistent discharge that outcome in a progressively durable, communitarian IT office and better items for end clients. All things considered, one key factor is regularly absent from the DevOps discussion: Accounts! For every one of its copious benefits, you'd be unable to discover an organization that hasn't overpaid for a cloud administration, especially when scaling up and making sense of how to tweak evaluating structures to meet your requirements. This is where FinDevOps, aka Financial DevOps, come into consideration. But FinDevOps is a monetarily disapproved approach that looks to cure this missing piece by carrying accounts into the overlap of advancement and tasks. Why? Curiously, most organizations that practice DevOps, regardless of whether in a full social grasp or basically using certain instruments, are shockingly improbable to have an apparatus explicitly for watching costs identified with DevOps. Those reports are regularly pointless about pinpointing the needle in the DevOps pile on what explicit change caused an evaluating peculiarity. By giving budgetary measurements in a visual, ongoing way, all offices can all the more likely comprehend explicit choices and their immediate effect on funds. It is this key territory that the developing field of FinDevOps tries to demystify.A Brief Overview of DevOps

DevOps is a hypothesis and set of general prescribed procedures that separate the divisions, or storehouses, between the conventional IT arms of activities and advancement. Organizations that convey spry workplaces see an improvement in inward correspondence and understanding when IT groups include both programming and operational exercises, maybe even inside a solitary representative. Practices like input circles and a culture of experimentation bring about improved in-house connections that advance effective items, progressively visit discharges, and, eventually, development. Know more about DevOps Processes here. In any case, DevOps Cultural Transformation relies vigorously on persistent input: this code versus that code, this element versus that element, presently versus later. One significant measurement that has been missing is Cost. For all the notoriety and volatility around DevOps, most DevOps apparatuses are missing cost measurements – the key measurement for business achievement.

DevOps is a hypothesis and set of general prescribed procedures that separate the divisions, or storehouses, between the conventional IT arms of activities and advancement. Organizations that convey spry workplaces see an improvement in inward correspondence and understanding when IT groups include both programming and operational exercises, maybe even inside a solitary representative. Practices like input circles and a culture of experimentation bring about improved in-house connections that advance effective items, progressively visit discharges, and, eventually, development. Know more about DevOps Processes here. In any case, DevOps Cultural Transformation relies vigorously on persistent input: this code versus that code, this element versus that element, presently versus later. One significant measurement that has been missing is Cost. For all the notoriety and volatility around DevOps, most DevOps apparatuses are missing cost measurements – the key measurement for business achievement.Finance and DevOps

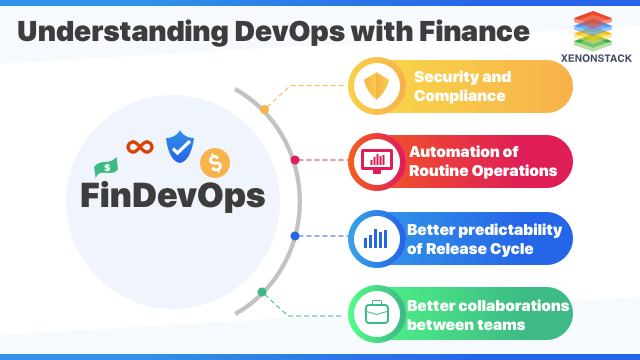

A blend of money related, improvement, and tasks, FinDevOps might be the following wilderness in DevOps culture and innovation. For quite a long time, IT and business divisions are by all accounts at philosophical chances: they convey unexpectedly, they work unexpectedly, and they organize unexpectedly. However, as innovation, as plagued and advanced each zone of a business, this philosophical loggerhead is harming – not helping – business achievement. With new FinDevOps devices, the fund group can better and all the more completely see how cash streams from IT. Outfitted with granular exactness and continuous updates, the money group can figure out which DevOps choices influence the main concern, giving knowledge into whether the advantage of a change merits the cost. Learn about DevOps Assembly Line with us and ease your understanding of the topic. All in all, what does FinDevOps do that conventional cost checking can't? Most undertakings cost the board alternatives that were created for reasons like revealing, consistency, and administration. In any case, IT overall and DevOps specifically depend intensely on developing cloud advances to remain little, adaptable, and quick, with constant arrangements on compensation for each utilization premise. Old fashioned cost the executive's devices produce week after week or month to month reports, regularly past the point where it is possible to tell whether this adjustment in code or that component rollout is answerable for an uncommon uptick in distributed computing. This leaves your fund group in obscurity on the best way to legitimize that cost and your IT groups uncertain how to clarify the underlying driver. FinDevOps apparatuses may offer highlights, for example, cost expectation, ceaseless cost control, and irregularity identification. It helps you follow all stock you keep up in the cloud, estimating assets and expenses to advance a solitary wellspring of truth. This single truth may sound overwhelming, yet along these lines of reasoning really advances DevOps methods of reasoning of exchange and procedure. With all colleagues getting to similar data, the discussion changes from habitual pettiness into the ROI's shrewd discourse. Read about DevOps SRE for related knowledge here.FinDevOps Transforming Financial Services

As said before, money related administration organizations face new difficulties in their everyday activities in fulfilling the guidelines set somewhere near the unicorns. To help the present advanced age, numerous budgetary administrations organizations are modernizing their back-end frameworks and procedures. Notwithstanding utilizing heritage frameworks and code, they can confront challenges in meeting administration prerequisites, agreeing to guidelines, and mitigating hazards for better security. These worries make the product development a moderate and complex procedure. Be that as it may, in recent years, the money-related administration division is driving the change regarding embracing the most recent advancements, and current programming conveyance works on including DevOps, consistent conveyance (CD), and Agile. Fund administrators see FinDevOps as an approach to acquire an incentive to the market in a progressively more secure and effective way. Presently, we should dive further into the manners by which is changing the fund scene.

As said before, money related administration organizations face new difficulties in their everyday activities in fulfilling the guidelines set somewhere near the unicorns. To help the present advanced age, numerous budgetary administrations organizations are modernizing their back-end frameworks and procedures. Notwithstanding utilizing heritage frameworks and code, they can confront challenges in meeting administration prerequisites, agreeing to guidelines, and mitigating hazards for better security. These worries make the product development a moderate and complex procedure. Be that as it may, in recent years, the money-related administration division is driving the change regarding embracing the most recent advancements, and current programming conveyance works on including DevOps, consistent conveyance (CD), and Agile. Fund administrators see FinDevOps as an approach to acquire an incentive to the market in a progressively more secure and effective way. Presently, we should dive further into the manners by which is changing the fund scene.Profitable Financial Services via FinDevOps

The Amazons and Googles of the world are murmuring along at an incredible rate regarding developing on present-day programming conveyance practices and quickly sending programming refreshes. These web-first, unicorn organizations encourage business at unimaginable paces and with a degree of deftness that acquires their clients' affection and reliability. They have made another standard and set exclusive administration standards that can be hard for different ventures to coordinate, especially in profoundly directed organizations, such as money-related administrations. DevOps is changing all that.Money related administration associations face incredible difficulties in fulfilling the new guidelines set by the unicorns. Many didn't begin on the web, and they're caught up modernizing back-end procedures and frameworks to help the present advanced age. Notwithstanding heritage frameworks and code, they face worries around moderating danger for better security, following guidelines, and meeting administration prerequisites, all of which make programming development a perplexing and moderate process. Or so you would think. Throughout the most recent couple of years, nonetheless, the monetary administration's industry has made up for a lost time. Executives in this moderate segment see DevOps as an approach to turn out an incentive to the market quicker, more proficiently, and all the more securely. FinDevOps empowers budgetary administrations to build the rhythm and nature of utilization discharges while additionally tending to administration, hazard, security, and consistency methodologies.Beware of little expenses, a small leak will sink a great ship

- Benjamin Franklin

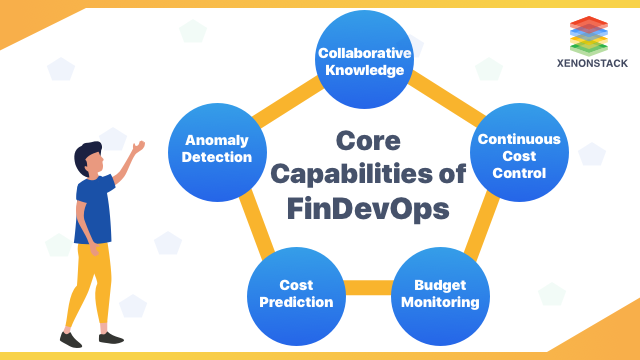

Core Capabilities of FinDevOps

Below given are 5 core capabilities of FinDevOps one must know:

Below given are 5 core capabilities of FinDevOps one must know:

1. Collaborative Knowledge

Knowing the stock of the considerable number of assets in your cloud surroundings, their connections, and their expenses is the "single wellspring of truth" for FinDevOps. Envision sending an asset (any asset) and watching its expense, or making a code or arrangement change and watching its impact on cost. When joined with connections, you can start to perceive how a change to one asset influences others' expenses.2. Continuous Cost Control

Knowing genuine costs, abnormalities, and patterns is significant input; however, where do you start to make a move to troubleshoot or improve your framework? You may utilize a DevOps device today to screen execution measurements, and maybe that apparatus causes you to discover the wellspring of an issue, regardless of whether that is mistakes or CPU usage. An instrument for FinDevOps needs to do something very similar. When you can watch costs associated straightforwardly to your framework and design, you will rapidly have the option to improve your framework and control operational expenses.3. Budget Monitoring

Knowing how your expenses are gathering, and by whom, to a point, later on, discloses to you how your operational expenses are following to spending plan. Moreover, if you utilized a multi-account procedure and solidified charging and need to allot expenses and spending plans to various cost-focuses, at that point, knowing the continuous breakdown of genuine costs will empower you to precisely assign expenses to specialty units, groups, items, and highlights.4. Cost Prediction

Knowing and dissecting your expenses over extensive stretches of time will reveal imperceptible patterns and anticipate expenses to a point later on. Imperceptible patterns can bring about significant expenses since they have gathered for quite a while. Distinguishing patterns are practically difficult to do outwardly, and investigation regularly requires AI calculations. With pattern recognition and cost forecast, you and your group will astound others with an elevated level of power over your expenses rather than accepting charging astonishments.5. Anomaly Detection

Knowing real-time resource costs helps you in observing billing anti-patterns. Most cost spikes are difficult to detect visually owing to the vast volumes of your billing data. The ability to automatically keep your system costs, discover the needles in the haystack, and differentiate between recurring spikes and real outliers will help you manage operational costs. FinDevOps enables you to know the risk to your business caused by varying degrees of anomalies. Now, 'End of the month' billing surprises will become a thing of the past.DevOps for Financial Services

The account is one industry that requests a consistent stream and the snappy conveyance of administrations to keep the business running. Higher client commitment and persistent exchanges make the business one of the busiest and normally requires a continuous foundation. Like in each other industry, the innovation unrest has changed how the monetary administration's industry works. The business is making progress toward an inside and out computerized change and is searching for innovation arrangements that can assist it with accomplishing its objectives. The use of customary IT shows causes administrative obstacles for some organizations, and these remaining parts the most concerning component, particularly for money-related administration firms. Subsequently, numerous budgetary assistance firms have started their journey for updating specialized foundation, both at the back-end and the front-end. Besides just innovation progressions, the arrangement that can offer consistent, quicker help conveyance and higher client commitment keep great importance for the money related administration industry.

The account is one industry that requests a consistent stream and the snappy conveyance of administrations to keep the business running. Higher client commitment and persistent exchanges make the business one of the busiest and normally requires a continuous foundation. Like in each other industry, the innovation unrest has changed how the monetary administration's industry works. The business is making progress toward an inside and out computerized change and is searching for innovation arrangements that can assist it with accomplishing its objectives. The use of customary IT shows causes administrative obstacles for some organizations, and these remaining parts the most concerning component, particularly for money-related administration firms. Subsequently, numerous budgetary assistance firms have started their journey for updating specialized foundation, both at the back-end and the front-end. Besides just innovation progressions, the arrangement that can offer consistent, quicker help conveyance and higher client commitment keep great importance for the money related administration industry.Leading FinDevOps Drivers in Finance

FinDevOps is making strides all over the place. By offering a course to discharging programming quicker, with fewer blunders, it can give organizations that receive it a prompt bit of leeway. Shockingly, it's not something you can purchase or choose to do tomorrow. Rather, it's a move that needs the correct direction to become a reality. Be that as it may, while there are huge difficulties and expenses to receiving DevOps, the advantages are too extraordinary to consider ignoring in the monetary business – similar to the dangers of not conveying an incentive to clients rapidly enough and losing clients to contenders or new fintech disruptors.DevOps has come to the best approach to address the critical need!

As the 2017 State of DevOps Report from DORA and Puppet shows, organizations and associations which grasp DevOps can normally send changes, updates, and upgrades multiple times all the more now and again. Their change disappointment rate is additionally multiple times lower, and they can recoup from disappointments when they do happen multiple times quicker. In the monetary administration part explicitly, there are three principal drivers for receiving DevOps.

1. Speeding Up Conveyance

Money related organizations are under expanding strain to discharge programming quicker. Regardless of whether it's new contestants to the market, for example, portable just banks, or any semblance of Apple and Google entering the versatile installments space, or expanded interest in fintech new businesses, change is astir. Receiving DevOps rehearses essentially speeds up conveyance, with high IT entertainers sending on various occasions every day and low entertainers sending once per week or even once per month.2. Lessening Personal Time

In its 2015 report, DevOps and the Cost of Downtime, IDC determined that, by and large, foundation disappointments cost enormous undertakings $100,000 every hour. The 2016 Cost of Data Center Outages report from the Ponemon Institute goes further, showing the expense of impromptu blackouts in the budgetary administration's industry is the most elevated of any business area, and more than twofold that of the open part. In an always aggressive industry, the present money related organizations can't bear these expensive mix-ups.3. Improving Consistency

The money related administration industry is one of the most profoundly directed areas on the planet. While presenting FinDevOps may, from the start, have all the earmarks of being the direct opposite of such guidelines, the inverse is valid. FinDevOps rehearses take into account more serious hazard the board, for instance, with little, iterative changes being completely tried by forms like consistent coordination. This thus prompts levels of certainty far higher than the customary programming improvement cycle. The 2017 State of DevOps Report found that superior workers invest half less energy remediating security issues than low entertainers.10 Secrets to FinDevOps Success

FinDevOps utilizes constant cost observing to remain on the front line of cloud and DevOps innovation. Some secrets to FinDevOps are as follows:- Strategically budgetary organizations need to concentrate alone explicit business drivers for Digital Transformation, conveying better programming less expensive and quicker, enhancing into new markets, and advancing in front of the challenge.

- Win over C-level officials and representatives endeavor wide by effectively embracing DevOps for one anticipate then as certainty develops and the procedures and culture are acknowledged turn it out further.

- Rewarding achievement and keeping away from an accuse culture is basic to DevOps achievement, and really FS associations loan themselves well to this sort of culture as by and large if things turn out badly, there is such a great amount in question that the various groups will, in general, dismantle together to fix it quickly.

- Moving to cross-utilitarian groups and presenting mechanization where it is generally required and prone to succeed are the foundations to progress.

- After preparing, empowering your groups to work independently with a self-administration ability to arrange their very own design and create tooling structures is basic.

- A base-up approach is best for better code and advancement, so empower engineers to utilize trusted and demonstrated open-source APIs and exploit containerization for institutionalization and productivity in any condition.

- Don't be enticed to unify, or you will wind up with your DevOps group itself working in a storehouse, which is deadly. Rather make a FinDevOps group for each business line, for instance, retail banking, credit, and speculation banking.

- Remember that your definitive objective is consistent reconciliation and persistent conveyance.

- Use the cloud to make test conditions that intently coordinate creation, available on request, and simple to scale up or down.

- Abolish the pressure and danger of large discharges and separate applications into reasonable microservices. Make a robotized system that is directly for your particular business and review normally to guarantee progressing effectiveness.

.webp?width=1921&height=622&name=usecase-banner%20(1).webp)