Why is Analysis in Banking and Finance Industry Required?

In the banking and financial sectors, the customer's primary requirements and expectations play an essential role in choosing or leaving the bank, consistency in services, a fully functional and long-term customer acquisition and retention program client needs. Today's customer wants a year-over-year trend analysis to get insights related to the performance over similar periods. Consumers also want a monthly growth, year over year comparison before concluding, and needs at the core of your business. Therefore Banking and Finance Analytics Platform or tool is necessary for financial data analytics.

Solution for Banking and Finance Analytics Platform

-

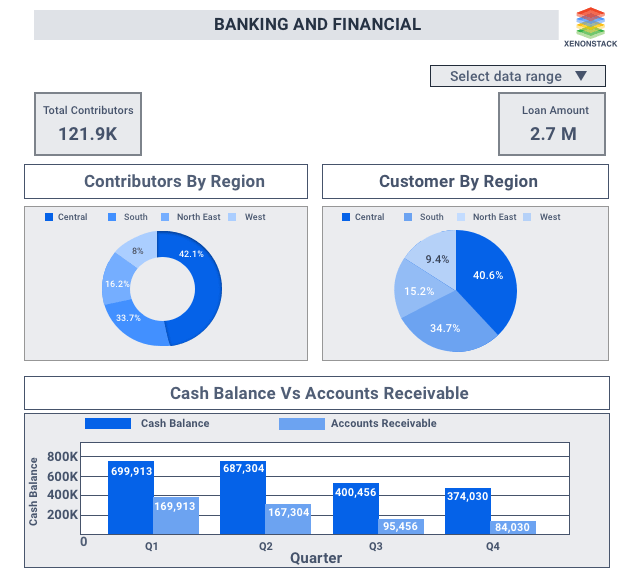

With Xenonstack Support, one can build accurate and predictive models on real-time data. To better understand the customer for getting the amount of banking with their cash balance and account receivable.

-

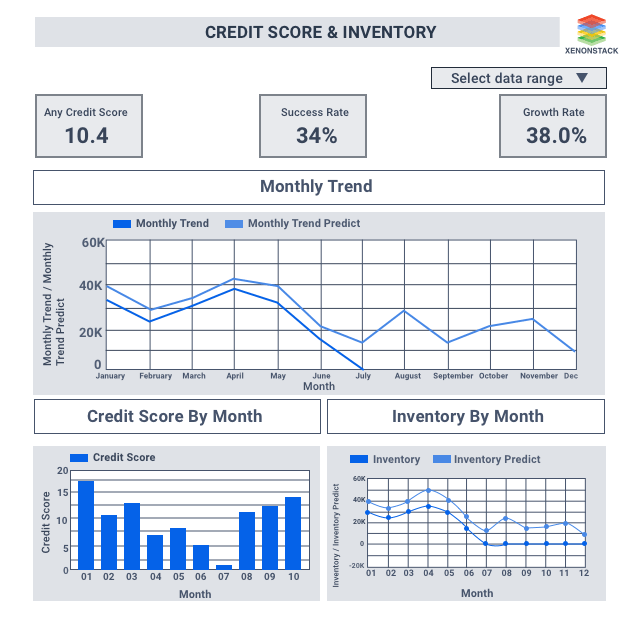

As a result, we have given a demo of the dashboard for reference. You will be confident after getting results for growth, monthly trends, credit score, and success rate using our C.

-

Users can quickly get all the information about the banking and financial industry by applying the models.

-

As for the result, our historical data of the bank industry. Using that data, we can predict things and get the results according to our models.

Why Xenonstack?

Click on a button and request us to give you a demo of our Machine Learning model. Here you will get insights related to the monthly trends, growth, and loan amount. Our Model will provide you an accurate prediction of the banking industry with their contributors and customers from different regions with narrative addition.

Dashboard

Description of Finance Analytics Dashboard

Described below are the benefits of the Banking and Finance Analytics Platform.-

Here our dashboard shows the total contributors and customers from a different region of the world.

-

Users can see the most number of contributors and customers from the central region. The user will also get information about the credit score and inventory every month.

-

The Machine Learning model analyzes the bank's account information quarterly with cash balance and account receivable.

-

The user can also see the Monthly trends of the financial and their success rate and the bank's growth rate along with their total loan amount. Here, the user will get the predicted inventory data and monthly trends.

.webp?width=1921&height=622&name=usecase-banner%20(1).webp)