In today’s complex regulatory environment, compliance is often perceived as a mandatory obligation rather than a strategic advantage. However, organizations that seamlessly integrate compliance into their operational framework can gain a significant competitive edge. A proactive compliance strategy enhances brand credibility, optimizes efficiency, and fosters long-term customer trust. Furthermore, in an era of increasing data breaches and regulatory scrutiny, companies prioritising compliance position themselves as industry leaders.

While compliance was traditionally viewed as a cost centre, modern businesses are beginning to recognize its potential as a value driver. Regulatory adherence improves operational efficiency, facilitates market expansion, and enhances investor confidence.

This blog presents a three-step integration playbook that helps organizations harness compliance as a driver for growth and differentiation.

Fig 1: Compliance as a Competitive Advantage

Fig 1: Compliance as a Competitive Advantage Step 1: Align Compliance with Business Strategy

1.1 Compliance as a Strategic Asset

Compliance extends beyond risk mitigation; it is a fundamental pillar for establishing trust and credibility in the market. Companies that demonstrate adherence to industry regulations gain confidence from customers, investors, and regulatory bodies. A well-structured compliance strategy enhances market positioning in the finance, healthcare, and technology industries, where data protection and governance are paramount.

Beyond regulatory requirements, compliance plays a role in business expansion. Companies struggle to enter new markets due to varying legal and regulatory requirements. A strong compliance program ensures businesses can efficiently operate across multiple jurisdictions, unlocking new revenue streams and partnerships. Additionally, compliance enhances corporate governance, making organizations more attractive to investors who prioritize transparency and ethical business practices.

1.2 Embedding Compliance into Core Business Functions

Organizations must integrate regulatory adherence into their strategic blueprint to leverage compliance as a competitive advantage. This includes:

-

Executive Commitment: Leadership must prioritize compliance and incorporate it into business objectives.

-

Risk-Based Compliance Management: Focus on regulatory areas with the highest business risks.

-

Measurable Compliance Metrics: Define KPIs (Key Performance Indicators) to assess compliance effectiveness.

-

Transparent Stakeholder Communication: Educate internal teams and external stakeholders on compliance initiatives to build credibility.

-

Integration with Business Operations: Compliance should not be a separate function but embedded into day-to-day business processes, making adherence more seamless and efficient.

1.3 Case Study: Financial Services and Regulatory Compliance

Financial institutions leverage compliance frameworks such as ISO 27001, GDPR, and PCI-DSS to reinforce trust and credibility. Industry leaders like PayPal and Stripe emphasize their compliance certifications as a market differentiator, demonstrating their commitment to secure transactions and regulatory adherence. Banks and fintech firms that proactively adopt stringent security measures have a competitive edge over those that reactively comply only when required.

Step 2: Leverage Technology for Compliance Optimization

2.1 Digital Transformation in Compliance Management

Modern regulatory requirements necessitate automated, real-time compliance management. Companies can leverage digital tools to streamline compliance processes, including:

-

AI-Driven Risk Analysis: Machine learning models help detect anomalies and predict compliance risks.

-

Blockchain for Audit Transparency: Blockchain ensures immutable record-keeping for secure compliance tracking.

-

Cloud Security and Compliance Tools: Platforms such as AWS Security Hub and Microsoft Defender enable organizations to maintain compliance in cloud environments.

-

Automated Compliance Audits: AI-powered auditing tools reduce manual errors and improve efficiency.

-

RegTech Solutions: Regulatory technology (RegTech) solutions offer real-time monitoring and reporting, ensuring that companies stay ahead of compliance requirements.

2.2 Integrating Compliance into DevSecOps and Cloud Security

As cloud adoption accelerates, integrating compliance into DevSecOps practices is essential. Organizations should adopt:

-

Shift-Left Security Approach: Implement security compliance checks early in the software development lifecycle.

-

Continuous Compliance Monitoring: Cloud-native tools such as AWS Config and Azure Policy monitor real-time compliance.

-

Automated Compliance Reporting: Deploy automated reporting solutions to simplify regulatory audits and assessments.

-

Incident Response Automation: Implement automated compliance workflows to manage security incidents in alignment with regulatory requirements.

-

Third-Party Compliance Management: Ensure vendors and partners comply with regulatory standards, reducing supply chain vulnerabilities.

2.3 Case Study: SaaS Providers and Compliance Leadership

A leading SaaS provider successfully leveraged compliance automation through SOC 2 and GDPR certifications, enhancing its appeal to security-conscious enterprise clients. The company gained a competitive advantage in the software market by showcasing compliance readiness in marketing and sales strategies. This approach strengthened client confidence and expedited procurement cycles, as compliance-ready vendors require less due diligence from prospective customers.

Step 3: Cultivate a Compliance-Centric Organizational Culture

3.1 Employee Training and Compliance Awareness

For compliance to become a competitive differentiator, organizations must embed it into their corporate culture. Effective approaches include:

-

Interactive Compliance Training: Scenario-based learning modules enhance team member engagement.

-

Regular Compliance Drills: Simulating audits and data breach scenarios prepares teams for real-world compliance challenges.

-

Cross-Functional Collaboration: Encouraging compliance, IT, and operations cooperation enhances regulatory alignment.

-

Personalized Learning Paths: Employees should receive training tailored to their roles and risk exposure.

-

Onboarding Compliance Programs: New hires should receive compliance training as part of their onboarding process, reinforcing its importance from day one.

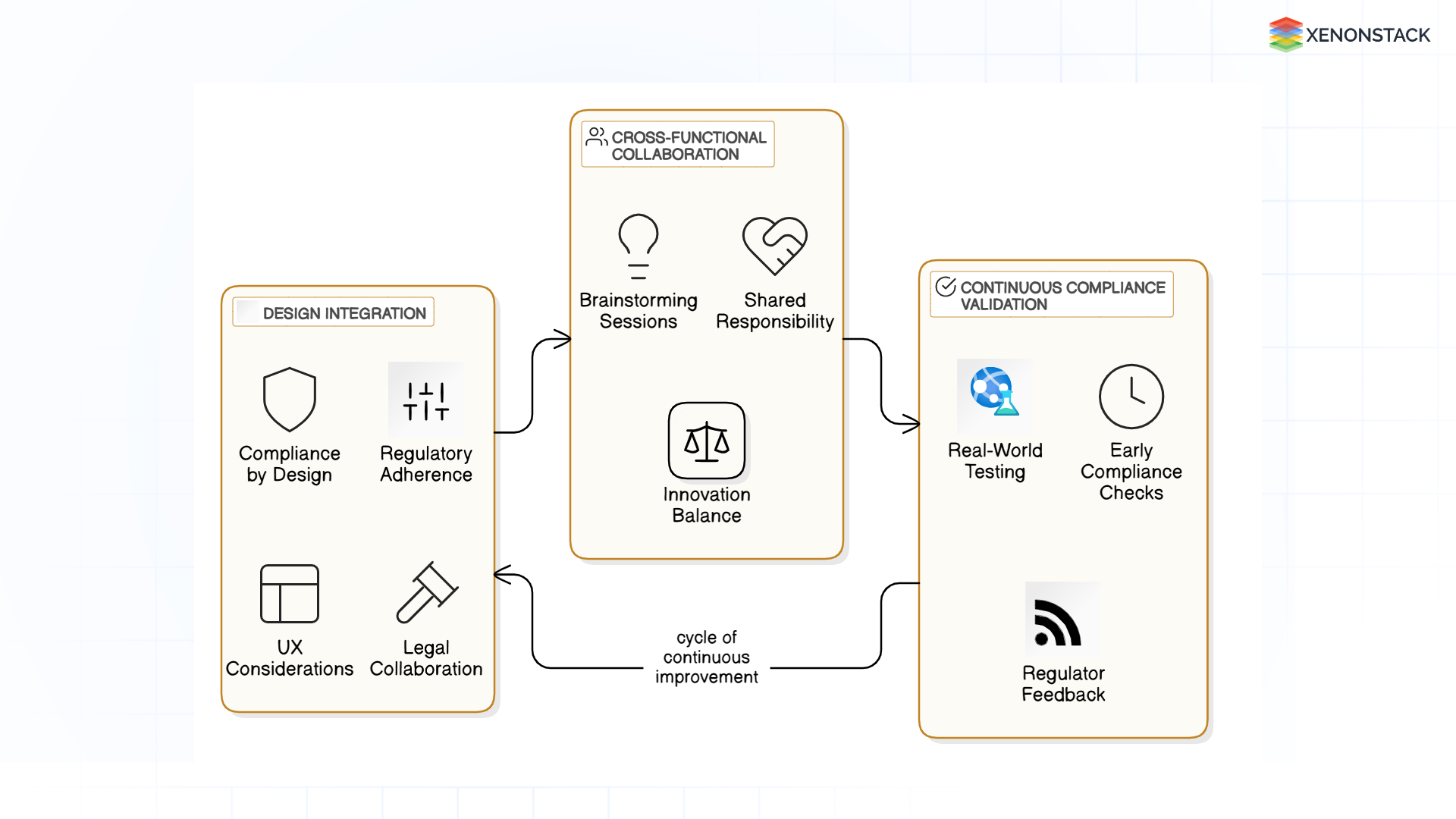

Fig 2: Seamlessly Integrating Compliance

Fig 2: Seamlessly Integrating Compliance3.2 Building a Compliance-First Mindset

To ensure compliance is an organizational strength, companies should:

-

Reward Compliance-Positive Behaviors: Incentivize employees who proactively uphold compliance standards.

-

Encourage Transparent Reporting: Establish whistleblower protection policies to promote accountability.

-

Leadership Advocacy: Senior executives should model compliance best practices to drive organization-wide adherence.

-

Embedding Compliance in Decision-Making: Ensure compliance considerations are part of strategic business decisions.

-

Regular Compliance Updates: As regulations evolve, businesses must continuously educate teams on new requirements and best practices.

3.3 Case Study: E-Commerce and Consumer Trust

A global e-commerce giant adopted stringent PCI DSS and GDPR standards to protect customer data. By prominently highlighting its compliance initiatives, the company strengthened customer trust, increased repeat transactions, and differentiated itself from competitors with weaker security protocols. As a result, the company saw higher customer retention rates and an improved brand reputation, proving that compliance can be an asset in customer acquisition and loyalty.

Conclusion of Compliance as a Competitive Edge

Compliance is no longer a mere regulatory requirement—it is a strategic lever that fosters competitive advantage, builds stakeholder confidence, and drives business growth. Organizations that integrate compliance into their core business strategy, adopt digital solutions for compliance automation, and cultivate a compliance-first culture will mitigate risks and position themselves as industry leaders.

Following this three-step integration playbook, businesses can transition compliance from a cost burden into a sustainable value and differentiation source in an increasingly regulated world. Companies proactively embracing compliance will be better equipped to navigate future regulatory changes, scale their operations, and maintain a strong market presence. Those who treat compliance as an afterthought may struggle to compete in an environment where transparency, security, and trust define long-term success.

Next Steps in Compliance as a Competitive Edge

Talk to our experts about implementing compound AI system, How Industries and different departments use Agentic Workflows and Decision Intelligence to Become Decision Centric. Utilizes AI to automate and optimize IT support and operations, improving efficiency and responsiveness.