How can businesses stay ahead of the growing risks that come with technological advancements and regulatory complexities? Traditional risk management approaches often struggle to adapt to the pace of change. Agentic AI, with its ability to make real-time autonomous decisions, is revolutionising how organizations manage risk. This blog explores how Agentic AI transforms industries by providing dynamic, data-driven solutions to tackle cybersecurity, fraud, and regulatory compliance—empowering businesses to act faster and smarter than ever before.

The Role of Agentic AI in Navigating Complex Risks

Risk management in highly regulated industries, such as financial services, healthcare, and energy, is a delicate balancing act. Organizations must constantly monitor evolving regulations, manage cybersecurity risks, and ensure compliance without compromising operational efficiency.

Agentic AI in Energy enables the industry to tackle challenges like optimizing energy use, detecting inefficiencies, and predicting future energy demands in real time, all while managing risks. Agentic AI excels in this environment by automating decision-making processes based on real-time data and pre-established risk frameworks.

By making decisions autonomously, Agentic AI can quickly assess and mitigate risks, reducing the burden on human teams while ensuring timely, data-driven actions. For instance, in financial services, Agentic AI can continuously scan transaction data, identify patterns indicative of fraud, and take corrective action—without human intervention. In industries like robotics, Agentic AI can optimize operations and ensure safety by automating complex tasks and adapting to environmental changes autonomously.

Why Agentic AI is a Game Changer in Risk Management

Businesses are increasingly adopting agentic AI to stay ahead of emerging risks and navigate the complexities of regulatory environments. Traditional risk management tools can only go so far, but agentic AI brings several key advantages:

-

Autonomous Risk Assessment and Action: Agentic AI can autonomously detect risk factors and execute predefined actions, such as stopping suspicious financial transactions, adjusting cybersecurity measures, or mitigating operational disruptions in robotics and energy management.

-

Real-time Learning and Adaptation: Unlike conventional systems, agentic AI continuously learns from incoming data, adjusting risk models and strategies in response to new threats or regulatory changes.

-

Predictive Risk Insights: By analyzing historical and real-time data, agentic AI predicts potential future risks and allows organizations to prepare ahead of time.

-

Dynamic Compliance: As regulations evolve, agentic AI adapts by automatically adjusting compliance frameworks and ensuring organizations remain up-to-date, reducing the risk of penalties or compliance failures.

The Impact of Agentic AI on Regulatory Compliance

Regulatory compliance is one of risk management's most time-consuming and costly aspects, particularly in industries like finance and healthcare. Organizations must stay on top of constantly changing regulations to avoid penalties, lawsuits, and reputational damage.

Agentic AI significantly enhances the ability to monitor and adjust to regulatory changes. It continuously scans for updates across various regulatory sources and automatically adjusts internal controls and compliance frameworks. This can ensure that the organization’s processes align with the latest requirements without manual intervention.

Practical Applications of Agentic AI in Risk Management

Fraud Prevention

In the financial sector, agentic AI can analyze patterns across millions of transactions, instantly flagging suspicious behaviour and initiating preventative measures, such as freezing accounts or blocking transactions in real-time.

Cybersecurity

Agentic AI systems can autonomously monitor and analyze network traffic, identifying anomalies or breaches in real-time. It can even adjust security protocols or isolate affected systems to minimize damage.

Regulatory Compliance

Keeping up with changing regulations can overwhelm compliance teams. Agentic AI can ensure ongoing compliance by automatically adjusting internal controls and processes to align with new laws and regulations.

Supply Chain Risk

Agentic AI assesses vendor performance and compliance in industries dependent on third-party vendors, ensuring that any risk associated with supply chain disruptions or non-compliance is mitigated.

Environmental, Social, and Governance (ESG) Risk

By analyzing data from various sources, agentic AI identifies and mitigates risks related to ESG factors, ensuring that companies comply with regulations and enhance their corporate reputation and sustainability efforts.

Key Benefits of Agentic AI for Risk Management

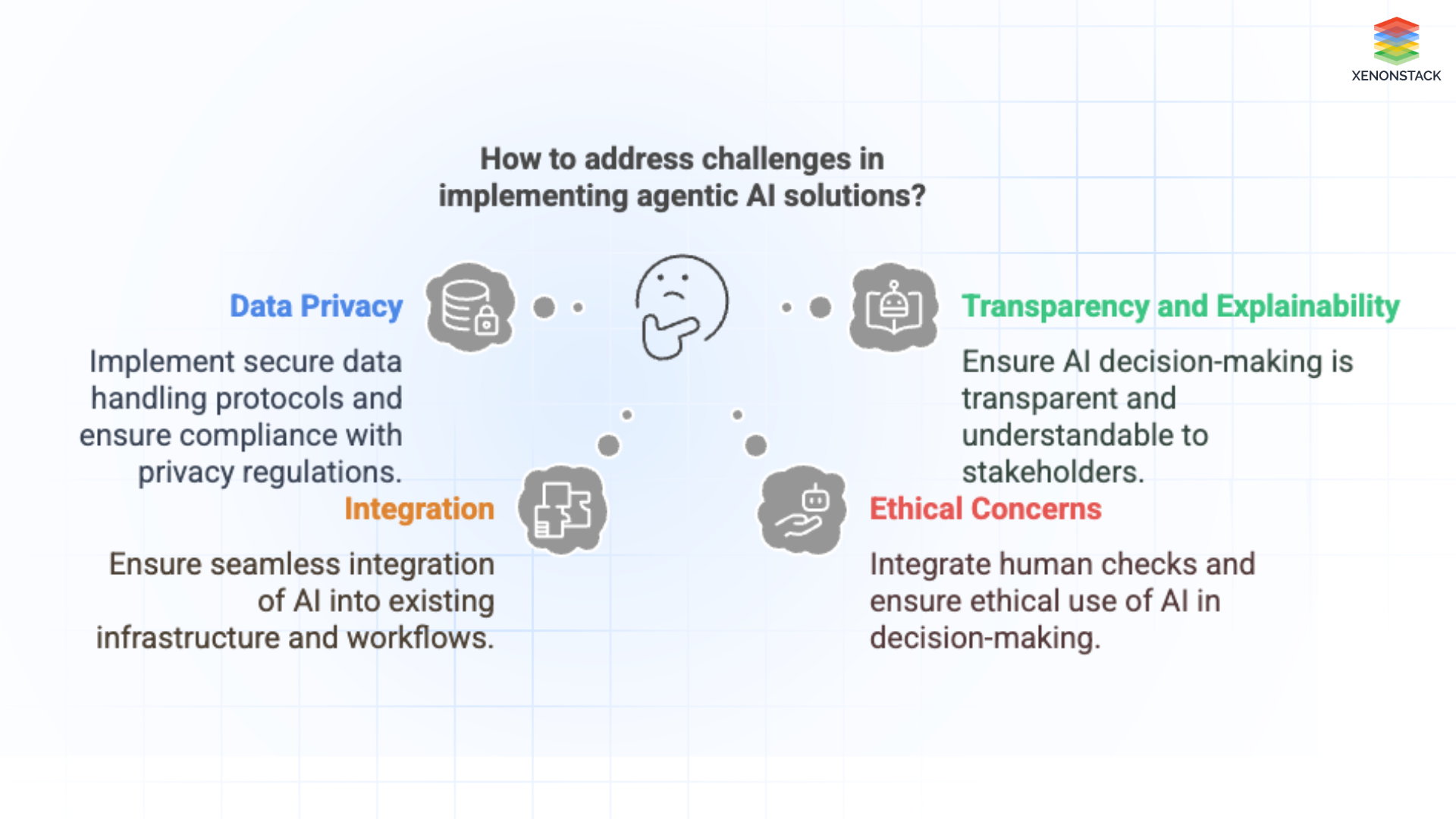

Key Challenges in Implementing Agentic AI Solutions

Fig 1: Challenges in implementing Agentic AI Solutions

Fig 1: Challenges in implementing Agentic AI SolutionsWhile the advantages of agentic AI are clear, its implementation is not without challenges:

Data Privacy

As agentic AI systems process vast amounts of data, protecting sensitive information is paramount. Companies must ensure AI models comply with privacy regulations such as GDPR and CCPA. Additionally, secure data handling protocols must be in place to safeguard against data breaches.

Transparency and Explainability

Given that agentic AI autonomously makes decisions, it’s crucial to ensure transparency when making these decisions. Stakeholders must understand the reasoning behind AI-generated choices, especially in highly regulated sectors like finance or healthcare.

Integration

Integrating agentic AI into existing infrastructure and workflows may present technical challenges. Companies must ensure that their data systems are compatible with AI technologies and that AI models can be seamlessly integrated into existing risk management tools.

Ethical Concerns

Ethical considerations related to agentic AI's autonomous decision-making. The lack of human oversight can be problematic, especially in industries where AI decisions could significantly impact people's lives. Ensuring ethical AI use and integrating human checks into decision-making processes is essential.

Agentic Process Automation Risk Management and Its Various Methods

Agentic Process Automation (APA) represents an advanced stage of automation where AI agents can independently perform complex business tasks. Unlike traditional automation systems, which follow predefined rules, APA systems exhibit autonomy, adaptability, and decision-making capabilities. These intelligent agents learn from their environment, interact with multiple systems, and improve over time.

Methods of Risk Management in Agentic Process Automation

To manage the above risks, organizations should deploy a combination of technical, operational, and governance-based approaches:

1. Risk Identification and Assessment Frameworks

-

Risk Mapping: Categorize all potential risk sources (e.g., technical, operational, compliance) and link them to specific APA use cases.

-

Impact Analysis: Evaluate the severity and likelihood of each identified risk to prioritize mitigation efforts.

-

Scenario Simulation: Use digital twins or simulations to observe how agents respond to abnormal or unexpected situations.

2. Governance and Oversight Mechanisms

-

Human-in-the-Loop (HITL): Introduce human oversight at critical decisions, especially when actions have legal or ethical implications.

-

Role-Based Access Control (RBAC): To prevent overreach, restrict agents' actions based on roles and permissions.

-

Audit Trails: Ensure all agent activities are logged in a detailed and immutable way to enable transparency and traceability.

3. Technical Risk Mitigation Strategies

-

Explainable AI (XAI): Deploy models that provide interpretable decisions so humans can understand and validate agent behaviour.

-

Testing and Validation Pipelines: Regularly test agent behaviours against edge cases, anomalies, and adversarial inputs.

-

Fail-Safe and Rollback Mechanisms: Design agents with the ability to revert to safe states or halt execution in case of unexpected behaviour.

4. Continuous Monitoring and Feedback Loops

-

Real-Time Monitoring Dashboards: Track agent performance, anomalies, and compliance metrics continuously.

-

Adaptive Control Systems: Implement feedback loops that allow agents to be recalibrated based on performance data.

-

Incident Response Plans: Develop protocols to quickly respond to agent-related incidents, including rollback, shutdown, and remediation.

5. Regulatory and Ethical Compliance Measures

-

Policy Alignment: Ensure agent goals and behaviours align with organizational policies and external regulations.

-

Bias Detection Tools: Use analytics and monitoring tools to detect and correct biased behaviour in learning agents.

-

Third-Party Audits: Conduct regular independent reviews of APA systems to ensure compliance with laws, industry standards, and ethical principles.

Agentic AI and the Future of Risk Management Trends

Fig 2: Future Trends in Agentic AI for Risk Management

Fig 2: Future Trends in Agentic AI for Risk Management

As agentic AI continues to evolve, its applications in risk management are expected to expand even further. Below are a few trends we hope to see in the future:

-

Wider Adoption Across Industries: While financial institutions are early adopters, agentic AI’s capabilities are becoming more widely recognized across sectors like healthcare, energy, and manufacturing. These industries can benefit from more agile and autonomous risk management processes.

-

Improved Decision-Making Capabilities: As AI learns, agentic systems will become more adept at making high-stakes decisions in complex scenarios, such as during a financial crisis or cybersecurity breach. Expect more sophisticated risk simulations and deeper predictive capabilities.

-

Collaboration Between AI and Humans: While agentic AI can make autonomous decisions, we expect that human oversight will still play a critical role. In the future, risk managers will work alongside AI systems to evaluate decisions and intervene when necessary, blending the best of both worlds.

-

Integration with Other Technologies: The convergence of agentic AI with technologies like blockchain, IoT, and edge computing will lead to more secure and responsive risk management frameworks. AI will become even more embedded in real-time operational decision-making, enabling dynamic risk mitigation across distributed networks.

Case Study: Financial Institution Adopting Agentic AI

Challenge

Solution

Results

-

90% Reduction in Fraudulent Transactions: The institution was able to drastically reduce the number of fraudulent transactions by identifying suspicious activities faster and taking immediate action.

-

Operational Efficiency: By automating large portions of the fraud detection process, the company saved significant resources and redirected personnel to higher-priority tasks.

The Ethical Use of Agentic AI in Risk Management

As organizations continue to adopt agentic AI, there will be an increasing focus on ensuring that these systems are used ethically. The power of AI to make decisions autonomously raises several ethical concerns, including:

-

Bias and Fairness: Agentic AI systems must be trained on high-quality, unbiased data to ensure that they do not perpetuate or amplify existing biases, especially in critical areas like loan approvals, hiring practices, and fraud detection.

-

Accountability: As AI becomes more autonomous in decision-making, it is important to establish clear accountability frameworks. Who is responsible when an AI system makes a flawed decision? Ensuring that businesses and regulators put accountability mechanisms in place will be key.

-

Impact on Employment: The rise of autonomous decision-making systems could lead to concerns about job displacement. While AI can improve efficiency, organizations must consider how to retrain workers for higher-value tasks that require human expertise.

Embracing Agentic AI for Proactive Risk Management

Agentic AI is poised to become an integral part of modern risk management strategies, enabling organizations to automate decision-making, predict risks, and ensure regulatory compliance with unprecedented speed and accuracy. While challenges such as data privacy, transparency, and ethical concerns remain, the advantages of using agentic AI to enhance risk management are undeniable.

As businesses continue to embrace this powerful technology, they will enhance their ability to mitigate risks and unlock new opportunities for efficiency, growth, and resilience. The future of risk management is autonomous, data-driven, and continuously evolving, with agentic AI leading the charge.

Next Steps in Adopting Agentic AI Solutions

Talk to our experts about implementing Agentic AI systems, how industries and different departments use autonomous decision-making workflows and decision intelligence to become risk-centric. Utilize AI to automate and optimize risk management and cybersecurity operations, improving efficiency and responsiveness.