In the rapidly growing complex financial environment, organizations in the field of wealth management seek to harness technology to improve competitiveness and enhance customer expectations. The use of historical data and machine learning algorithms to provide estimates of future trends within a business is known as predictive analytics – one of the main subcategories of advanced data analytics that are transforming the investment advisory market.

Predictive analytics enhance customers’ experience, create personalized wealth management strategies, manage portfolios more efficiently, and predict future market trends accurately and with very high accuracy. Ends with very high accuracy. This blog will explore predictive analytics in wealth management, its main uses, strengths and limitations, and how it revolutionises investment consultation.

Understanding Predictive Analytics

Applied to wealth management, predictive analytics involves using financial history, markets, and consumer behaviour to provide estimated results and suggestions. The three levels include data mining for trend analysis, machine learning, and statistical algorithms to analyze useful findings in investment decisions.

Wealth managers can use predictive analytics to gain insights into:

-

Market Trends: Investment decisions are based on expectations of changes in the stock markets, interest rates, or global conditions.

-

Client Behavior: Examining a client's risk profile, how the client spends his money, and what investments he is willing to make.

-

Portfolio Performance: Deciding what investment portfolio performance outcomes can be expected based on previous experience.

Figure 1: Illustrating Full Spectrum of Analytics: From Descriptive to Prescriptive

Figure 1: Illustrating Full Spectrum of Analytics: From Descriptive to Prescriptive

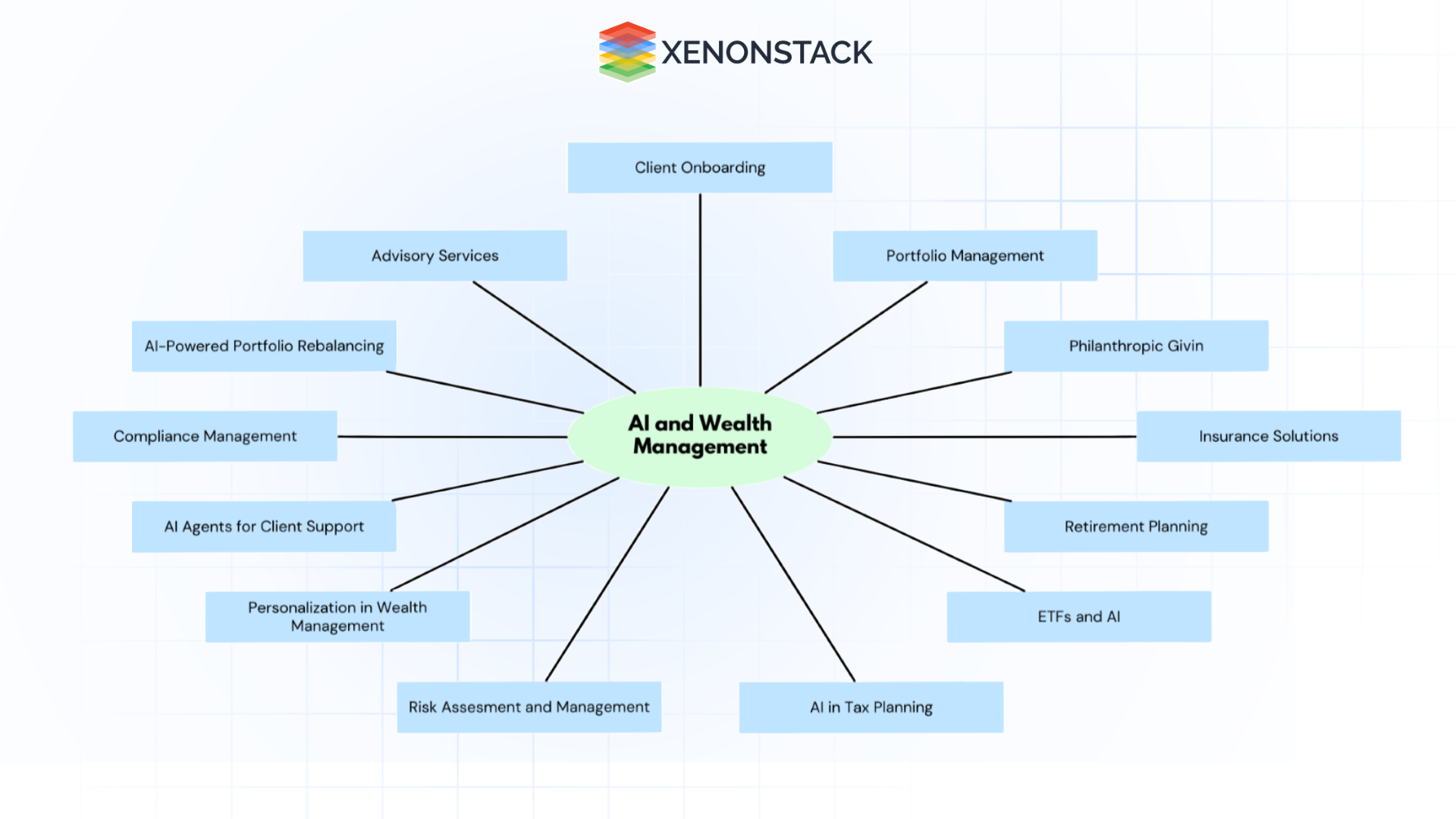

Applications of Predictive Analytics in Wealth Management

Customer Relationship Investment Advisory

-

Use Case: Offering tailored services about each customer’s situation.

-

How It Works: Predictive models help select portfolios based on small quantitative details about a client, financial goals, and the acceptable level of risk, considering past investment performance.

-

Example: Retirees need a low-risk portfolio, and the advisor provides good information on investing in bonds and stocks that yield good dividends.

Risk Management – Risk Evaluation and Risk Control

-

Use Case: The exposure of investment portfolios to certain risks.

-

How It Works: Risk assessment using predictive analytics involves comparing possible risks with certain trends and using stress testing about a portfolio.

-

Impact: The managers themselves can make changes ahead of time and protect their client portfolios from downtrends.

Client Retention and Acquisition

-

Use Case: Improving their ties to their clients and discovering potential customers.

-

How It Works: Analytical pieces of software work through the client’s data to look for signs of dissatisfaction and churn and recommend potential ways to interact with the client.

-

Example: Suggesting that firms initiate contact with those high-net-worth clients who have diminished activity or displays of disaffection.

Tax-Efficient Strategies of Investment

-

Use Case: Tax loss: managing portfolios to reduce tax implications.

-

How It Works: The quantitative analysis predicts the tax consequences of trades and can recommend either tax-loss harvesting or rebalancing.

-

Impact: Clients get better after-tax realization, increasing general wealth creation.

Fraud and Its Prevention

-

Use Case: The main concerns are detecting potentially fraudulent transactions and safeguarding its customers’ funds.

-

How It Works: Patterns of financial transactions are analyzed using artificial intelligence algorithms, such as machine learning, to identify fraudulent actions.

-

Example: Reporting to the wealth managers on suspicious check-outs or any movement of funds or stock in clients’ accounts.

Benefits of Predictive Analytics in Wealth Management

-

Enhanced Decision-Making

Predictive analytics equips wealth managers with actionable insights, enabling them to make data-driven decisions rather than relying solely on intuition.

-

Improved Client Satisfaction

Wealth managers can build stronger relationships and improve client satisfaction by delivering personalised advice and proactively addressing client concerns.

-

Greater Efficiency

Automating data analysis and reporting reduces manual work, allowing wealth managers to focus on strategy and client interactions.

-

Competitive Advantage

Firms that adopt predictive analytics can differentiate themselves by offering innovative services and outperforming competitors in portfolio performance and client retention.

Challenges of using Predictive Analytics in Wealth Management

-

Enhanced Decision-Making

Predictive analytics provides wealth managers with analytical information to guide them rather than base decisions on their instincts.

-

Improved Client Satisfaction

Proactive responses to client concerns or relevant recommendations help wealth managers foster good client relationships.

-

Greater Efficiency

The application of analytics would reduce the manual work required to categorize large chunks of data, thereby freeing up wealth managers to consider other issues, such as formulating strategies and engaging clients.

-

Competitive Advantage

Predictive analytics used in firms show the strong possibility of delivering new services and enhancing competitor’s portfolio performance and client satisfaction rates.

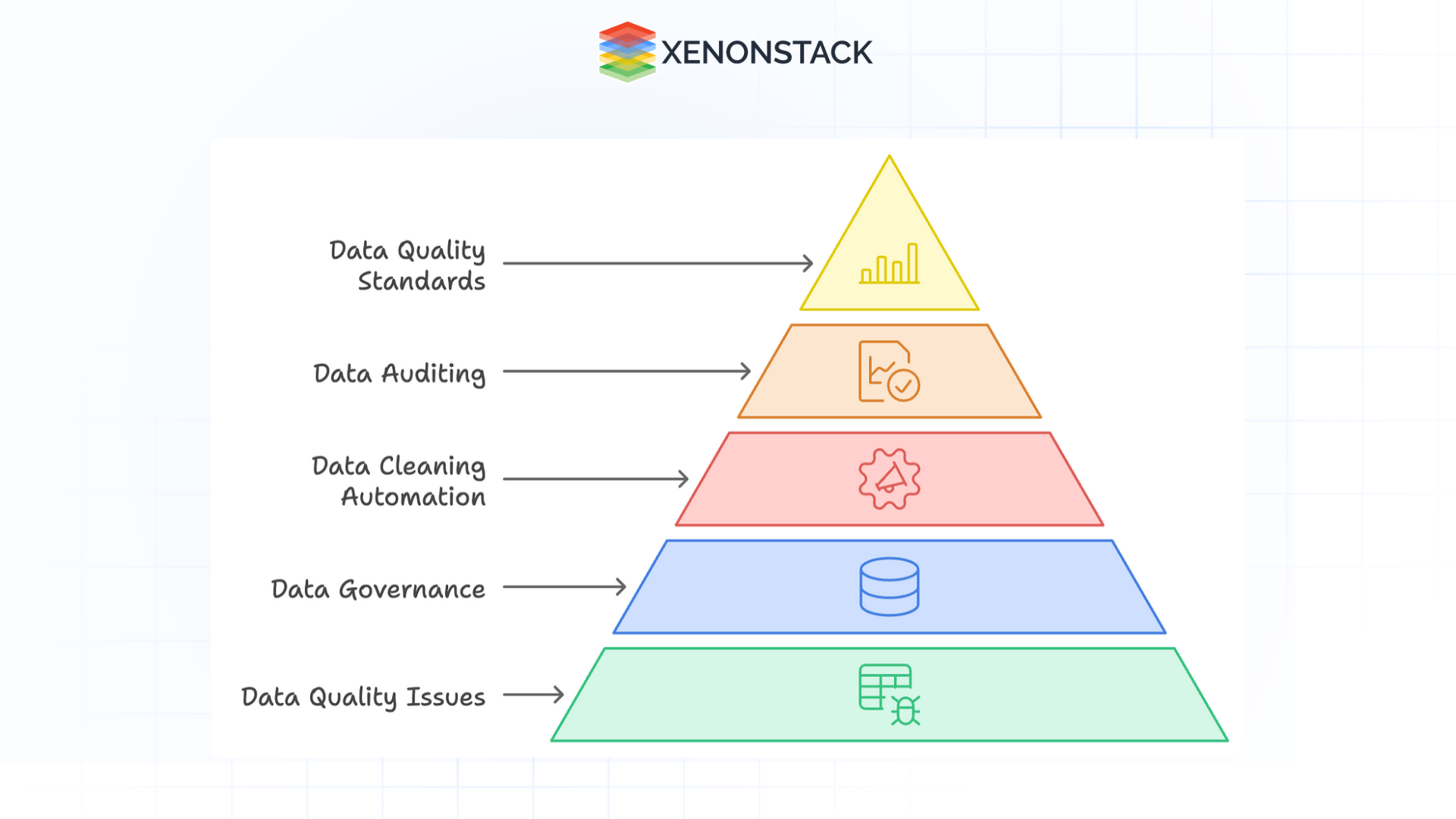

Figure 3: Data Quality Hierarchy

Figure 3: Data Quality Hierarchy How to Overcome Challenges

-

Focus on Data Governance: Adopt good data management policies that enable data quality, compliance and standardization at a reasonable cost.

-

Put money into Explainable Artificial Intelligence (XAI): Employ them to enhance the explainability and understanding of AI-driven predictions, enhancing our client’s faith in the same recommendations.

-

Integrated Cloud-Based Solutions: No large capital investments are necessary to integrate predictive analytics, as cloud platforms provide the infrastructure for such solutions and allow growth at lower expenses.

-

Upskill Workforce: Teach wealth managers and analysts the importance of data science and AI methodologies so that they can use predictive analytical tools.

Real-World Examples of Predictive Analytics in Wealth Management

Morgan Stanley

Another business area that has adopted predictive analytics is Morgan Stanley's wealth management division, which has enhanced its sales by using AI instruments to propose customized investment solutions and define potential lucrative points.

Vanguard

It also uses modelling to predict which of its clients is likely to withdraw their funds, among other things, to take the necessary action to retain them.

Betterment

Betterment is an online investment service provider that applies data science techniques to provide tax-smart portfolios, optimize portfolios, and auto-rebalance.

Future Trends in Predictive Analytics for Wealth Management

Integration of Real-Time Data

The new generation of predictive systems will use social media feeds, news feeds, and IoT devices to deliver highly accurate, real-time results.

Increased Use of Computer Technology, Specifically Natural Language Processing (NLP)

Unstructured data, such as news articles and earnings reports, are areas where NLP will strongly boost firms' existing predictive ability.

Expansion of Robo-Advisors

Smartphones driven by artificial intelligence will improve as robo-advisors, achieving a level of personalization and strategy close to that of human-like advisors.

Ethical AI Practices

The main trends show that as AI spreads its roots to wealth management, the critical focus on ethical approaches to AI methods and models, including fairness and transparency in theoretical and predictive analyses, will become the cornerstone of further advances.

The financial application of big data through predictive analytics revolutionises wealth management by enabling advisors to promptly offer solutions informed by data relevant to the client's needs. Engaging in activities ranging from risk evaluation to tax optimization, the application fields remain extensive and profound as predictive analytics help firms work more effectively and satisfy clients while competing effectively.

However, hurdles like data amalgamation and compliance are still tricky despite significant progress in AI, cloud premises, and explainable models. In the ever-changing financial environment, predictive analytics will form the foundation of the future of investment advisory, where wealth managers will provide immense value through managing risk and delivering enhanced results for their clients.

- Real Estate Development

- Real Estate Investment Evaluation

- Evaluating the right time to invest

Next Steps in Predictive Analytics

Talk to our experts about implementing compound AI systems and how industries and different departments use Decision Intelligence and Predictive Analytics in Wealth Management to become decision-centric. Learn how AI automates and optimizes IT support and operations, enhancing efficiency and responsiveness.